The past 18 months will be written about in the history books and taught in schools; movies will be made, and books written. In addition to our personal and work lives, the global COVID-19 pandemic continues to impact the financial markets and, as advisors can attest, clients' emotions.

The recent research, BeFi Barometer 2021, released by the Investments & Wealth Institute in collaboration with Schwab Asset Management and Cerulli Associates, aimed to understand how advisors viewed and used behavioral finance when working with clients. In its third year, the study focused on the behavioral biases prior to, during and coming out of the pandemic.

The research shows that there has never been a more critical time for advisors to incorporate behavioral finance principles. These techniques help manage and align clients' emotions with the advisory process necessary to achieve their long-term goals.

Continued Benefits for Advisors and Their Clients

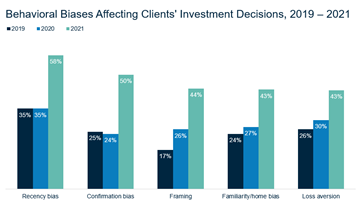

The study found a sharp increase across the board regarding the biases advisors reported. At the same time, advisor biases remained consistent with previous years, although loss aversion (33%) was slightly less prominent, while overconfidence (30%) was more pronounced than prior years. We found that implementing a systematic behavioral process could potentially help reduce their impact.

The study found a sharp increase across the board regarding the biases advisors reported. At the same time, advisor biases remained consistent with previous years, although loss aversion (33%) was slightly less prominent, while overconfidence (30%) was more pronounced than prior years. We found that implementing a systematic behavioral process could potentially help reduce their impact.

The Influence of Social Media

This year's study provided a fascinating peek into society and the role social media has come to play in everyday life, even influencing investments. From GameStop and meme stocks to the rise of Bitcoin and NFTs, social media feeds have been flooded with investment advice and news.

These trends on social media and with investors, along with their implications, underscore the importance of an advisor's advice and the value of behavioral finance.

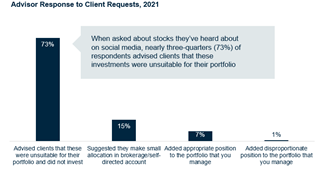

This year's BeFi Barometer 2021 found that just over half (52%) of advisors had clients asking questions related to social media somewhat often and frequently. Only three percent reported never receiving these inquiries. When asked about stocks clients have heard about on social media, nearly three-quarters (73%) of respondents advised clients that these investments were unsuitable for their portfolio. But what can advisors do to address these inquiries and prepare for the future GameStop-esque meme stock?

"Meme-stocks, Special-purpose Acquisition Companies (SPACs), and Non-fungible Tokens (NFTs) drew a lot of attention from the media, but for individuals with advisors, these phenomena ended up having relatively little impact on client portfolios," observed Asher Cheses from Cerulli Associates. Adding, "the majority of advisors surveyed indicated that none of their clients invested in NFTs (91%), meme stocks (76%), and SPACs (67%)."

Impact on Portfolio Construction

Advisors needed to balance their client emotions with their portfolios. More than one-quarter (28%) of advisors reported that they attempted to increase clients' comfort level with taking risks and counteracting negative biases, an increase from 24% from the year prior. As the market fluctuated, advisors made consistent communication and portfolio construction adjustments.

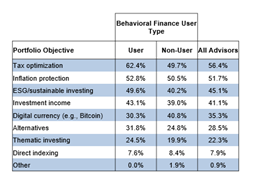

Interestingly, the study also looked at the difference behavioral finance made in the portfolio construction realm as well as the investment tactics advisors utilized.

Interestingly, the study also looked at the difference behavioral finance made in the portfolio construction realm as well as the investment tactics advisors utilized.

Advisors who used behavioral finance tactics were more inclined to use sophisticated strategies like tax optimization and a phased investment strategy than non-users.

Parting thoughts

As we move through the next 12 months and enter the "new normal," it will be essential for advisors to use what they have learned, adjust plans and have conversations to assess their clients emotional state, risk tolerance level and appetite for change.

While advisors are very in-tune to the biases they see in their clients, it will be equally important for advisors to remember that they are subject to the same emotional responses. They should keep in-check their own biases as they navigate the next year.

"This year's results underscore the importance of ongoing communication and place emphasis on key investment principles that advisors are using to guide clients through this period of volatility," remarked Omar Aguilar, Ph.D. Managing Director and Chief Investment Officer, Head of Investments at Schwab Asset Management.

“More than ever before, advisors have opened their behavioral finance tool chests. Implementing systematic behavioral strategies could potentially help advisors successfully maneuver the “new normal” moving forward.” said Devin Ekberg, CIMA®, CPWA®, CFA®, Chief Learning Officer and Managing Director of Professional Development at the Investments and Wealth Institute.

How we can help:

Looking for the latest tools and resources for strengthening your client outcomes using behavioral finance strategies?

- Get your copy of the BeFi Barometer 2021 here.

- Join us for BeFi Week to get all the latest behavioral finance strategies and best practices, learn more here.

Important Disclosures

Schwab Asset Management is not affiliated with Cerulli Associates or the Investments & Wealth Institute.

Information provided is for general informational purposes only and should not be considered individualized recommendations or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market, economic and political conditions. Some of the statements may be forward-looking and contain certain risks and uncertainties.

All corporate names are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security.

Schwab Asset Management is the dba name for Charles Schwab Investment Management, Inc. (CSIM). Schwab Asset Management is a part of the broader Schwab Asset Management Solutions organization (SAMS), a collection of business units of The Charles Schwab Corporation aligned by a common function—asset management-related services—under common leadership. CSIM and Charles Schwab & Co., Inc. (Schwab) Member SIPC are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation.

0921-1P33