“Experience is simply the name we give our mistakes.” Oscar Wilde

Don’t continue to let behavioral biases impact portfolio construction. By acknowledging that advisors are subject to many of the same behavioral biases as clients new report, Mitigating the Impact of Advisors’ Behavioral Biases, will show advisors how they can improve their portfolio construction and management processes.

New white paper helps advisors avoid costly biases

Oscar Wilde made the observation, “Experience is simply the name we give our mistakes.” We all know that it is often difficult to recognize our own imperfections and mistakes. In the same way, internal behavioral biases are often even more difficult to recognize because they are so ingrained and inherent. However, in the last few decades the study of behavioral finance has emerged, helping us to understand and to address the impacts that behavioral biases have on our decisions, especially when it comes to money and finances.

Advisors and clients agree that addressing behavioral finance is necessary for better long-term investing. With all the behavioral finance research and advice published, why do advisors continue to struggle with behavioral biases? Research study by Charles Schwab Asset Management, The Befi Barometer 2019, explored the difficulty in translating theory into implementation. Their new white paper, Mitigating the Impact of Advisors’ Behavioral Biases, has the solution and will help advisors improve portfolio construction and management process through the application of behavioral finance.

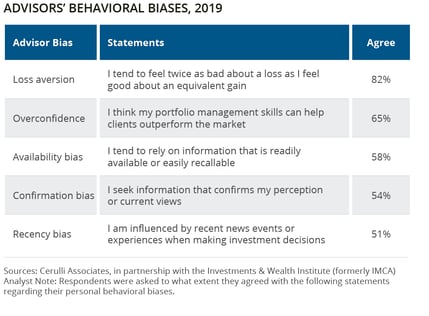

To improve their clients’ long-term financial outcomes, advisors must first understand how their own predispositions and behavioral biases can impact client portfolios before taking measures to counteract them. The BeFi Barometer 2019 survey revealed advisors top five behavioral biases, the survey identified loss aversion (82%), overconfidence (65%), availability (58%), and confirmation (54%) as the behavioral biases most likely to be affecting them.

The new white paper offers three ways for advisors to add value for clients through behavioral finance best practices:

-

- Implementing a rigorous process-driven portfolio management structure can help mitigate the impact of behavioral biases of advisors and clients.

- The “best” portfolio for a client is one that is customized to maximize the probability of securing their financial objectives while remaining within the client’s investment risk comfort level.

- Ongoing communication is essential to assuring the portfolio remains aligned with clients’ evolving financial statuses.

Identifying and mitigating the impact of the behavioral biases is an integral part of advisory relationship. Advisors must adopt a proactive approach to reduce the impact of these behavioral biases. In doing so advisors significantly strengthen the value of the services they deliver to their clients. Read the full report, Mitigating the Impact of Advisors’ Behavioral Biases, to learn more about how advisors can substantially decrease their exposure to behavioral biases and practical principles they can start applying today to add value to their clients and improve portfolio management.

Full report: Mitigating the Impact of Advisors’ Behavioral Biases