New White Paper by Charles Schwab Investment Management in collaboration with the Investments & Wealth Institute and Cerulli Associates, is now available.

Mitigating the Impact of Advisors’ Behavioral Biases – New White Paper by Charles Schwab Investment Management in collaboration with the Investments & Wealth Institute and Cerulli Associates, is now available

Mitigating the Impact of Advisors’ Behavioral Biases report shows advisors how they can improve their portfolio construction and management processes by acknowledging their own biases and develop safeguards to prevent costly mistakes.The last couple of years have raised the awareness of behavioral finance and the benefits of incorporating its principles into advisor’s everyday communication with their clients. With the emergence of pronounced market volatility in the first quarter of 2020, it has never been more important for advisors to understand the biases that can undermine their portfolio management efforts.

Last year’s report, The Role of Behavioral Finance in Advising Clients, illustrated that advisors can play a key role in helping clients understand common behavioral biases and establish guardrails to avoid emotional decision-making.

The top five behavioral biases that advisors identify as impacting their clients’ investment decisions:

The top five behavioral biases that advisors identify as impacting their clients’ investment decisions:

- Recency bias (being easily influenced by recent news events or experiences): 35%

- Loss aversion bias (playing it safe or accepting less risk then they can tolerate): 26%

- Confirmation bias (seeking information that reinforces their perception): 25%

- Familiarity/home bias (a preference to invest in familiar/U.S. domiciled companies): 24%

- Anchoring bias (a tendency to focus on specific reference points when making investment decisions): 24%

Source: Befi Barometer 2019

The Role of Behavioral Finance in Advising Clients also explored the most frequent challenge advisors face in using behavioral finance principles in their practices – the difficulty in translating theory into implementation. The new white paper, Mitigating the Impact of Advisors’ Behavioral Biases, will help advisors do just that.

Mitigating the Impact of Advisors’ Behavioral Biases will help advisors understand the biases to which they may be subject. It explores how advisor biases may be affecting their client relationships and offers advisors specific suggestions to help build and maintain portfolios that optimize client opportunities to achieve their desired outcomes, given their risk preferences.

Key Takeaways:

-

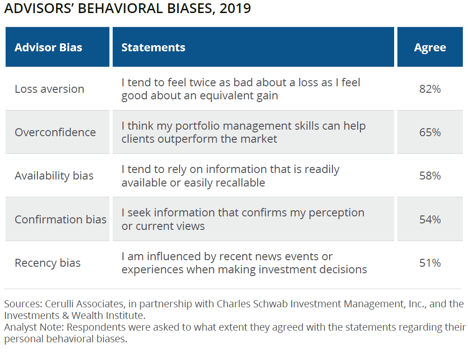

- Advisors are most likely to self-identify loss aversion, overconfidence, availability, and confirmation as the behavioral biases affect them.

- Implementing a rigorous process-driven portfolio management structure can help mitigate the impact of behavioral biases of advisors and clients.

- The “best” portfolio for a client is one that is customized to maximize the probability of securing their financial objectives while remaining within the client’s investment risk comfort level.

- Ongoing communication is essential to assuring the portfolio remains aligned with clients’ evolving financial statuses.

It is important for advisors to understand that they are subject to the same emotional responses as their clients. However, the value of advisors is deeply tied to overcoming these challenges to improve the likelihood of clients reaching their short and long-term financial objectives. Advisors can enhance the client experience by identifying their behavioral tendencies and creating a disciplined investment process that reduces the impact of these tendencies.

Identifying and mitigating the impact of the behavioral biases is an integral part of advisory wealth management relationships. Embracing a proactive approach to reducing the impact of these biases enables advisors to strengthen the value of the services they deliver to their clients. Advisors can substantially decrease their exposure to behavioral biases by applying the principles outlined in the new white paper Mitigating the Impact of Advisors’ Behavioral Biases in their practice.

Read the full report: Mitigating the Impact of Advisors’ Behavioral Biases