By: Tony Davidow

By: Tony Davidow

"With the anticipated growth of asset allocation model portfolios, advisors need to be able to effectively evaluate and compare the various providers in the marketplace."

We think the growth of models is a good thing – and a natural evolution for the industry. SMAs didn’t negate the value of advisors - rather it shifted the value proposition to selecting the right combination of SMAs to meet client goals and objectives.

With robust raw materials, models can provide broad diversification to virtually all segments of the markets. The models can provide global macro exposure or be used to generate income through retirement. The models can be geared towards maximizing returns in rising markets or dampening volatility in choppy markets. Because of the diverse nature of these models, advisors may choose to utilize multiple models with their clients depending upon what they’re trying to solve for.

Advisors now have a multi-faceted toolbox leveraging the resources and expertise of a broad set of proprietary and third-part partner firms. Consequently, the value of the advisors is determining how best to use these models to achieve their client’s goals, dreams and aspirations.

Evolving Asset Allocation

In the early 1990s, the ‘60/40’ allocation became a popular benchmark portfolio, taking the lead from many large pension plans. Investors gained most of their returns from their stock allocation - and income came primarily from their bond allocation. The long-term historical average of the S&P 500 has been 10.2% (1970-2018), and the long-term yield on bonds has been over 4%. Therefore, the naïve 60/40 portfolio provided attractive returns and income, with some level of diversification. Advisors could easily shift their allocations to generate higher returns or higher income to accommodate investors needs over time.

But what if equity returns and bond yields are lower over the next 10-20 years? What if the correlations among asset classes remains elevated? Does the 60/40 portfolio still work for our clients? In fact, many have questioned the merits of the 60/40 portfolio given the current market environment1.

Models should include broader diversification across their equity and fixed income allocations – and may include exposure to certain types of alternative investments. The broader diversification can assist in increasing the return, reducing the risk and providing non-correlating returns.

In recent years, many advisors have become enamored with the growth of U.S. large company stocks and some have questioned the merits of allocating abroad. Of course, making decisions based on short-term results can be short sighted – and lead to missed opportunities. Recency bias is a common problem for investors as they extrapolate short-term results and assume they will persist in the future.

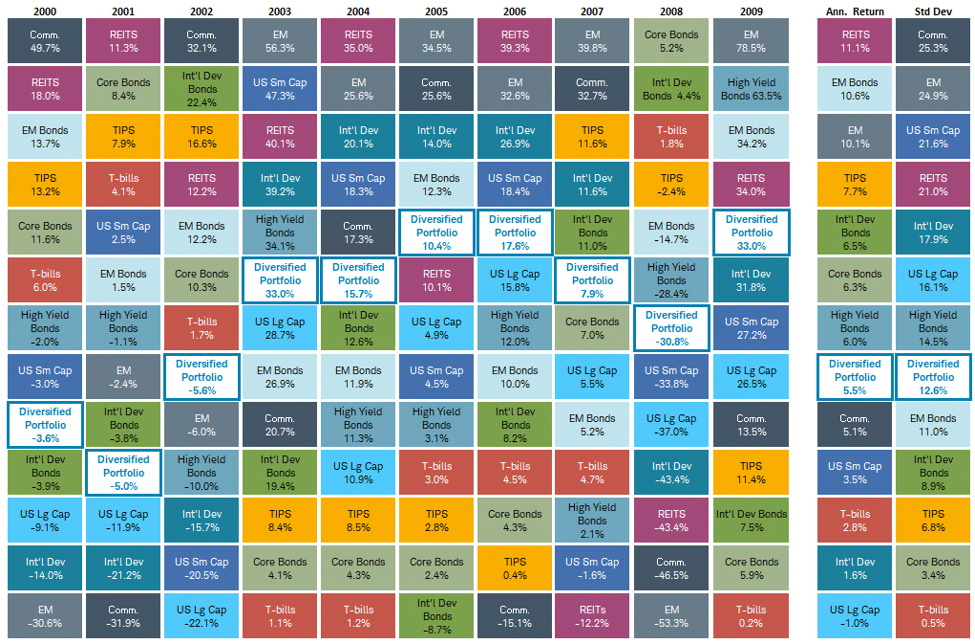

How quickly we forget the lessons of "The Lost Decade". From January 2000 to December 2009, U.S. Large Cap was the only major asset class that delivered negative cumulative returns. Emerging Markets debt and equity delivered double-digit results over the decade.

The Lost Decade

Source: Morningstar Direct

The Diversified Portfolio owns each of the asset classes in the appropriate weight thereby ‘smoothing’ the ride. The Diversified Portfolio will never be the best or worst performing asset class – but hopefully it will keep clients invested in both rising and falling markets.

Asset Allocation & Portfolio Construction

There are a number of asset allocation and portfolio construction considerations in evaluating model portfolios. The following represent a few key issues:

- Static versus Dynamic Allocation

- Active versus Passive Investing

- Incorporating Smart Beta Strategies

- The Role & Use of Alternatives

Given the dynamic nature of today’s markets, advisors may want to consider models that incorporate some form of tactical approach in responding to changing market conditions. We wouldn’t recommend making big swings in and out of the market – but rather subtle shifts to better position portfolios given the prevailing market conditions.

Exchange-Traded-Funds (ETFs) are great building blocks in portfolios. They offer broad-based exposure to virtually every market, in a cost-effective, tax-efficient wrapper. ETFs have evolved from ‘cheap beta’ strategies to ‘smart beta’ strategies. Smart Beta strategies, also known as Strategic Beta strategies, attempt to improve the market results either by improving returns or reducing risks2. Many attempt to exploit known Factors which have strong academic underpinnings.

While ETFs provide a cost-advantage relative to most active strategies - active managers may be best equipped to play defense and navigate through challenging market environments. Certain difficult to access asset classes - like alternative investments – may be better accessed via an active structure.

One of the primary roles of alternative investments is to dampen portfolio volatility3. The role and use of alternatives is an important consideration with multiple implications. What specifically are you solving for? Does your client meet the accreditation standards? Does the model provide diversified alternative exposure?

"The value of the advisor is utilizing models to help achieve their goals and objectives. This is more than asking a series of generic questions and turning the portfolio over to a robot. It’s understanding your client’s unique wants, needs and desires – and using the new tools in an appropriate fashion."

Asset allocation is both art and science.

1 Davidow, Anthony. “Why Global Asset Allocation Still Makes Sense: Revisiting Modern Portfolio Theory”, Investments & Wealth Monitor, January / February 2017

2 Davidow, Anthony, “Strategic Beta Strategies: Do they work outside of our borders?”, Investments & Wealth Monitor, November / December 2018

3 Davidow, Anthony, “Alternative Investments: A Goals-Based Framework”, Investments & Wealth Monitor, January / February 2018