The financial services industry is at a key inflection point, with a number of trends shaping the future of advice, including fee compression, the rise of passive investing, disruptive technology, the need for advanced education, and the lack of practice diversity. These changes have led to a transformation in how advisors serve their clients' needs and their value proposition.

Over the last several years, we have begun to see a bifurcation of advisory models, with smaller investors being pushed towards some form of robo-offering, and high-net-worth investors being served by wealth advisors. To address the needs of HNW investors, many advisors have needed to improve their investment acumen and expand their team’s capabilities.

Practice Evolution

Financial advisors serving HNW investors are often called “wealth advisors”—a term that better reflects the work they do for their clients - but which also meant that advisors need to reinvent themselves and provide new and different services to their clients. That reinvention requires new skills and education. Advisors need a better understanding of trust and estate issues, concentrated positions, tax management, lending options, and charitable giving, among other issues. Advisors often formed teams, with diverse skills and experiences, to tackle these areas.

To meet the investment needs of HNW investors, advisors may need advanced education on a broader set of investment options, including ETFs, factor investing, and alternative investments (hedge funds and private markets). Advisors need to understand the merits of the strategies and the various structures from open-end funds, closed-end funds, hedge funds, feeder funds, tender offer funds and interval funds to name a few.

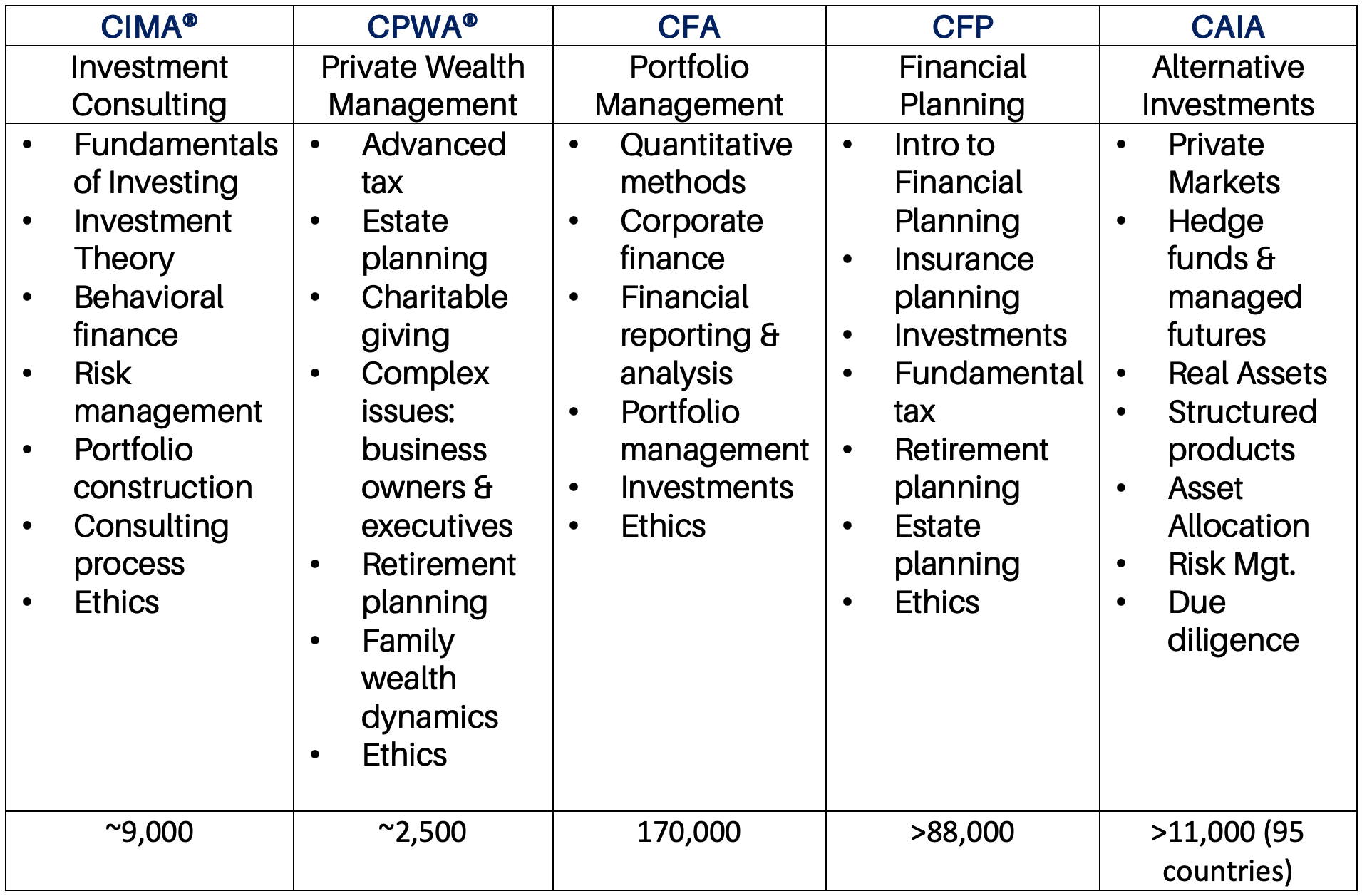

Many of the large wealth management firms have developed internal training programs to educate their advisors around the needs of HNW investors and improving financial advisors’ investment acumen. Many financial advisors have taken advanced education programs from industry organizations such as the Investments & Wealth Institute (IWI), CFA Institute, CAIA Association, and Financial Planning Association (FPA), among others.

Table 1: Education as a Differentiator

As of January 2021

These advanced designations help advisors distinguish themselves in a crowded marketplace. Many advisors have attained multiple advanced designations to fulfill their intellectual curiosity. These lifelong learners are motivated to remain the best at their profession.

Practice Diversity

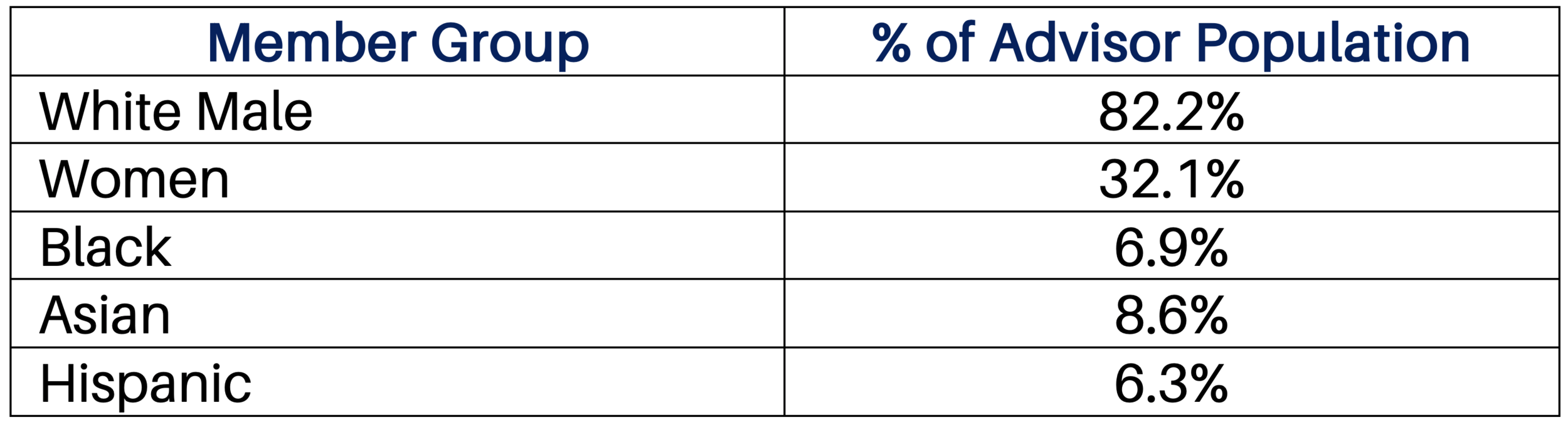

In addition to developing a team with diverse expertise, advisors should carefully consider their teams’ diversity. The financial services industry has long been dominated by older white men. As an industry, we need to do a much better job in attracting women, minorities, and younger professionals. Teams benefit from diverse perspectives, and investors want to engage with people who are more like them.

Table 2 shows the demographic breakdown of financial advisors, including the percentage of women, African American, Asian, and Hispanic advisors. Women represent more than half of the U.S. population, but make up a mere 32.1 percent of the advisor population, which is substantially more than the percentage of African American, Asian, and Hispanic advisors (6.9%, 8.6%, and 6.3%, respectively).

Table 2: Percentage of Women and Minority Advisors

Source: Bureau of Labor Statistics, 2019

Women represent a substantial growth opportunity. As McKinsey predicts, “An unprecedented amount of assets will shift into the hands of U.S. women over the next three to five years, representing a $30 trillion opportunity by the end of the decade.”[1] Attracting and retaining women investors will be of critical importance. Financial advisors need to include spouses and children in fostering relationships with HNW families. They need to think about the transfer of wealth to the next generation.

Tiger Woods had a profound impact on the game of golf, not just because of his otherworldly talents, but perhaps more importantly because he broke the stereotype that golfers are a bunch of rich white men. Tiger inspired kids with his athletic prowess and that fact he looked different than other golfers: his father was African American and his mother was Asian. A generation of male and female golfers have grown up idolizing Tiger Woods. Minority children saw someone who looked like them succeed and were inspired by his amazing accomplishments.

As an industry, we need to do a much better job mentoring and promoting women and minorities. We need to profile successful leaders and advisors - and develop programs for future generations. The Investments & Wealth Institute’s THRIVE initiative represents a positive development in bridging this gap.

Conclusion

The Financial Services industry has evolved a great deal over the last several decades, and has responded to a myriad of challenges, to better serve investors. Wealth advisors who seize the opportunity to evolve their teams and practices will flourish in the future; and those who resist change risk becoming obsolete.

[1] Boghai, Howard, Prakash, & Zucker, “Woman are the next wave of growth in U.S. wealth Management”, July 29, 2020

More from Tony:

Upcoming from the Exceptional Advisor Webinar Series:

- September 16, 2021 | “Money Jobs”: Is your money working for you?

- November 18, 2021 | How to Assess Retirement Readiness for Your Clients

To learn more about the upcoming Exceptional Advisor Webinar Series or to register click here.

Tony Davidow, CIMA®

Tony Davidow is an author and the President and Founder of T. Davidow Consulting, LLC, an independent advisory firm focused on the needs and challenges facing the financial services industry. Davidow leverages his diverse experiences to deliver research and analysis to sophisticated advisors, asset managers and wealthy families. He’s held senior leadership roles at Morgan Stanley, Charles Schwab, Guggenheim Investments and IndexIQ, among others.

Davidow currently serves as the Chair, Investment & Wealth Monitor, Editorial Advisory Board, and Host for the Exceptional Advisor Webinar Series. He’s also a member of the Investments & Wealth Institute WealthBoard 100 Advisory Board.

In 2020, Davidow was awarded the Wealth Management Impact Award by the Investments & Wealth Institute. In 2017 he received the Stephen L. Kessler Writing Award, and in 2015 he received the Stephen L. Kessler Writing Award (Honorable Distinction).

Coming this October, a new book from Tony Davidow, CIMA®, Goals-Based Investing: A Visionary Framework for Wealth Management. Learn more about Goals-Based Investing here. Available for pre-order on Amazon and Barnes & Noble

To read more from Tony visit: tdavidowconsulting.com