Investment consulting has a long history that has been marked by innovations occurring about every 10 years. This blog is Part 2 of our three-part 70-Year History Series. This blog explores 1986-2005.

This blog is part 2 of a three-part series covering the evolution of investment consulting. Check back in on September 29th for part 3. To read Part 1: 1950–1985, click here. To read Part 3: 2006-Present, click here.

The 70-Year History of Investment Consulting

By Ron Surz, President, Target Date Solutions, President & CEO, PPCA Inc., CFO, GlidePath Wealth Management

Part 2: 1986-2005

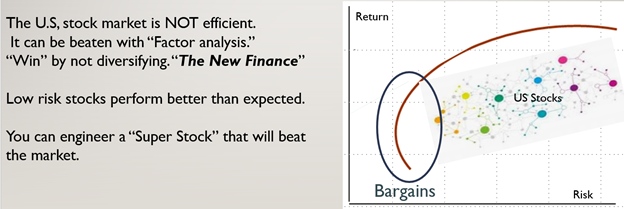

1986: Factor-Based Investing - Dr. Haugen

Robert F. Haugen, PhD, is the father of factor-based investing. A prolific writer, Haugen wrote hundreds of articles and books about identifying investment factors that produce alphas, superior returns. These factors include fundamentals such as yield and capitalization, and classifications such as industry-sector and style. Haugen set the academic profession on its ear with the heresy that broad markets can be beaten. His legacy is the fairly common use of factor-based investing today and the recent “discovery” of “smart beta.”

alphas, superior returns. These factors include fundamentals such as yield and capitalization, and classifications such as industry-sector and style. Haugen set the academic profession on its ear with the heresy that broad markets can be beaten. His legacy is the fairly common use of factor-based investing today and the recent “discovery” of “smart beta.”

Haugen identified the existence of a return premium in minimum-variance portfolios, as shown in the next graph. Today it is called smart beta.

1986: The Determinants of Portfolio Performance

In apparent contradiction to Haugen’s work, in 1986 Gary Brinson, L. Randolph Hood, and Gilbert Beebower published “Determinants of Portfolio Performance,” documenting that asset allocation explained most of investment performance. The allocations to asset classes like stocks and bonds explained virtually all of the performance in pension funds. A careful read reveals that the report is actually about volatility, as measured by R-squared. Asset allocation explained about 95 percent of the volatility in portfolio performance. Using the same data provided in the article, we find that asset allocation actually explained 100 percent of performance.

So how does this square with Haugen’s work? Most pension portfolios were not using factor-based investing in the 1980s, and that fact remains today. Only a few institutional investment firms utilize factor-based techniques.

1991: Post-Modern Portfolio Theory

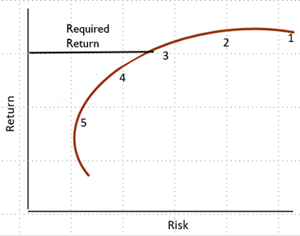

About 30 years ago, Frank Sortino, PhD, AKA Dr. Downside, proposed a new way to define risk, and introduced post modern portfolio theory (PMPT). Risk in the PMPT world is the possibility that you will not achieve your objectives. Objective-based investing was born, as was the now popular Sortino ratio.

About 30 years ago, Frank Sortino, PhD, AKA Dr. Downside, proposed a new way to define risk, and introduced post modern portfolio theory (PMPT). Risk in the PMPT world is the possibility that you will not achieve your objectives. Objective-based investing was born, as was the now popular Sortino ratio.

Sortino wrote two books on portfolio construction (The Sortino Framework for Constructing Portfolios: Focusing on Desired Target Return™ to Optimize Upside Potential Relative to Downside Risk and Managing Downside Risk in Financial Markets) designed to achieve objectives and has made his software available for free, including source code. Consultants use a  simplified version that begins by solving for a rate of return that will achieve the client’s objective. Sortino calls this the minimum acceptable return (MAR). The MAR is then used to locate a model on the efficient frontier, as shown in the graph on the right:

simplified version that begins by solving for a rate of return that will achieve the client’s objective. Sortino calls this the minimum acceptable return (MAR). The MAR is then used to locate a model on the efficient frontier, as shown in the graph on the right:

Note the similarity between the old risk-based approach and the new objective-based process. Both use a family of models along the efficient frontier. Risk-based uses the horizontal scale (risk) to locate a solution, while objective-based uses the vertical scale (return) to find an answer. This reliance on a handful of models was about to change, as will be discussed in Part 3.

To read Part 3: 2006-Present click here.

###

See a recorded webinar of this history here.

Ronald J. Surz is president of PPCA Inc. and its division, Target Date Solutions. He is a pension consulting veteran, having started with A.G. Becker in the 1970s. He earned an MBA in finance from the University of Chicago and an MS in applied mathematics from the University of Illinois. He has published regularly in such publications as the Journal of Wealth Management, the Journal of Investing, Journal of Portfolio Management, Pensions & Investments, Senior Consultant, Horsesmouth, and Investments & Wealth Monitor, as well as contributed to and edited several books. Ron's most recent book is Fiduciary Handbook for Understanding and Selecting Target Date Funds: It's All About the Beneficiaries. Ron has served as a member of the following boards and councils:

Ronald J. Surz is president of PPCA Inc. and its division, Target Date Solutions. He is a pension consulting veteran, having started with A.G. Becker in the 1970s. He earned an MBA in finance from the University of Chicago and an MS in applied mathematics from the University of Illinois. He has published regularly in such publications as the Journal of Wealth Management, the Journal of Investing, Journal of Portfolio Management, Pensions & Investments, Senior Consultant, Horsesmouth, and Investments & Wealth Monitor, as well as contributed to and edited several books. Ron's most recent book is Fiduciary Handbook for Understanding and Selecting Target Date Funds: It's All About the Beneficiaries. Ron has served as a member of the following boards and councils:

- Investment Management Consultants Association (now the Investment & Wealth Institute) Board of Directors

- State of Alaska Investment Advisory Board

- City of San Clemente Finance Committee

- Several CFA Institute Committees

- Sortino Investment Advisors Advisory Committee

- Capital Market Consultants Advisory Committee

References

Brinson, Gary P., L. Randolph Hood, and Gilbert L. Beebower. 1986. Determinants of Portfolio Performance. Financial Analysts Journal 42, no. 4 (July–August): 39–44.

Haugen, Robert F. 1999. The Inefficient Stock Market: What Pays Off and Why. New York: Prentice Hall

Markowitz, Harry. 1952. Portfolio Selection. Journal of Finance 7, no. 1 (March): 77–91.

Pfau, Wade D., and Michael Kitces. 2013. Reducing Retirement Risk with a Rising Equity Glide-Path (September 12). https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2324930.

Sharpe, William F. 1964. Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk. Journal of Finance 19, no. 3 (September): 425–442.

Sortino, Frank A. 2009. The Sortino Framework for Constructing Portfolios: Focusing on Desired Target Return to Optimize Upside Potential Relative to Downside Risk. Elsevier.