The Investments & Wealth Institute (formerly Investment Management Consultants Association) was founded in 1985 by eight investment consultants. The aim was to broaden public understanding of investment consulting and increase the professionalism of those providing consulting services through education, ethics, and certification. In the 35 years since our founding at lot has changed in the industry, however the Institute is only half as old as the industry itself.

This blog is part 1 of a three-part series covering the evolution of investment consulting. To read Part 2: 1986–2005 click here, for Part 3: 2006-Present click here.

The 70-Year History of Investment Consulting

By Ron Surz, President, Target Date Solutions, President & CEO, PPCA Inc., CFO, GlidePath Wealth Management

Part 1: 1950–1985

Investment consulting has a long history that has been marked by innovations occurring about every 10 years. This blog is Part 1 of our three-part 70-Year History Series. This blog explores 1950–1985.

It is incredible that “modern” portfolio theory is about 70 years old. It has stood the tests of time and is currently embraced by many consultants. Harry Markowitz, PhD, won a

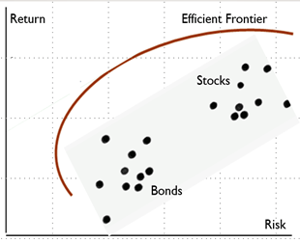

Nobel Memorial Prize in Economic Sciences in 1990 for educating investors on the magic of diversification and the existence of an “efficient frontier” that maps portfolios that earn the highest expected return for a given level of risk. The following graph forms the basis for modern portfolio theory (MPT):

Every stock or bond has risk and expected return. Risk is measured as the standard deviation of returns—volatility. Investors will take risk only if the expected return is high enough. The graph shows examples of stock and bond risk-reward. The big breakthrough is that combinations of stocks and bonds earn higher returns for the risk, shown along the efficient frontier. Diversification is an immensely powerful investment tool.

Investors will take risk only if the expected return is high enough. The graph shows examples of stock and bond risk-reward. The big breakthrough is that combinations of stocks and bonds earn higher returns for the risk, shown along the efficient frontier. Diversification is an immensely powerful investment tool.

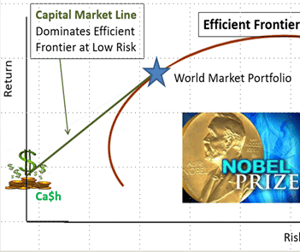

12 years later William F. Sharpe, PhD, (who was also awarded the 1990 Nobel Memorial Prize in Economic Sciences). extended the work of Markowitz by introducing the capital asset pricing model (CAPM) that postulated everyone should want to hold the most diversified portfolio

because it provides the highest return-to-risk ratio, called the “Sharpe ratio.” The most diversified portfolio is the “world market” of all risky assets in the world, held in proportion to their market values. An integral aspect of the theory is the “capital market line,” which states that risk is best controlled with cash. Every investor should want to hold the market portfolio and, if this is too risky, use cash to reduce risk. The resulting line dominates the efficient frontier, providing higher expected returns for the risk. This breakthrough is not used much by consultants because they prefer to not control risk with cash. However, most consultants use alpha and beta regression statistics that were first introduced by CAPM.

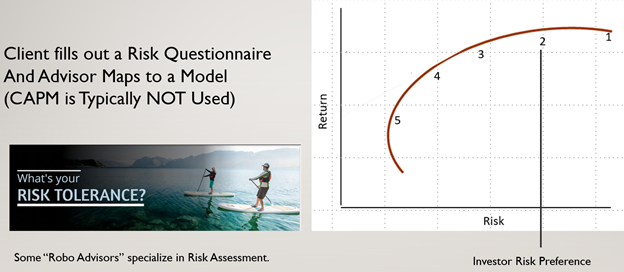

Mapping Risk Tolerance into Models

In the early days of consulting, MPT was used to map a client’s risk tolerance into a model portfolio, as shown in the following graph.

The original idea of “risk tolerance” is the maximum risk the client can tolerate because high risk earns high returns. This approach changed in the 1990s with the introduction of objective-based investing, discussed below. As shown along the curve above, model portfolios are located on the efficient frontier. Then risk questionnaires identify investor risk tolerance that is used to find the best model. The “60/40 rule” emerged from this practice because most mappings gravitate to the middle toward Model 3 in the graph above. Broad use of the 60/40 rule remains entrenched today. The typical investor is 60/40 equities/bonds, so model providers and turnkey asset management platforms (TAMPs) tend to focus on this model.

1974: The Employee Retirement Income Security Act (ERISA)

About 50 years ago Congress passed ERISA to govern the practices of fiduciaries. This law remains today as the teeth for prosecuting bad fiduciary behavior. Importantly for consultants, parts of the law reinforce the wisdom of diversification to avoid the risk of large losses. Ironically, 12 years later this all changes. The next innovator we will cover in Part 2 showed that you cannot diversify and win the investment performance game. You have to make big bets.

About 50 years ago Congress passed ERISA to govern the practices of fiduciaries. This law remains today as the teeth for prosecuting bad fiduciary behavior. Importantly for consultants, parts of the law reinforce the wisdom of diversification to avoid the risk of large losses. Ironically, 12 years later this all changes. The next innovator we will cover in Part 2 showed that you cannot diversify and win the investment performance game. You have to make big bets.

To read Part 2: 1986–2005 click here.

###

See a recorded webinar of this history here.

Ronald J. Surz is president of PPCA Inc. and its division, Target Date Solutions. He is a pension consulting veteran, having started with A.G. Becker in the 1970s. He earned an MBA in finance from the University of Chicago and an MS in applied mathematics from the University of Illinois. He has published regularly in such publications as the Journal of Wealth Management, the Journal of Investing, Journal of Portfolio Management, Pensions & Investments, Senior Consultant, Horsesmouth, and Investments & Wealth Monitor, as well as contributed to and edited several books. Ron's most recent book is Fiduciary Handbook for Understanding and Selecting Target Date Funds: It's All About the Beneficiaries. Ron has served as a member of the following boards and councils:

Ronald J. Surz is president of PPCA Inc. and its division, Target Date Solutions. He is a pension consulting veteran, having started with A.G. Becker in the 1970s. He earned an MBA in finance from the University of Chicago and an MS in applied mathematics from the University of Illinois. He has published regularly in such publications as the Journal of Wealth Management, the Journal of Investing, Journal of Portfolio Management, Pensions & Investments, Senior Consultant, Horsesmouth, and Investments & Wealth Monitor, as well as contributed to and edited several books. Ron's most recent book is Fiduciary Handbook for Understanding and Selecting Target Date Funds: It's All About the Beneficiaries. Ron has served as a member of the following boards and councils:

- Investment Management Consultants Association (now the Investment & Wealth Institute) Board of Directors

- State of Alaska Investment Advisory Board

- City of San Clemente Finance Committee

- Several CFA Institute Committees

- Sortino Investment Advisors Advisory Committee

- Capital Market Consultants Advisory Committee

References

Brinson, Gary P., L. Randolph Hood, and Gilbert L. Beebower. 1986. Determinants of Portfolio Performance. Financial Analysts Journal 42, no. 4 (July–August): 39–44.

Haugen, Robert F. 1999. The Inefficient Stock Market: What Pays Off and Why. New York: Prentice Hall

Markowitz, Harry. 1952. Portfolio Selection. Journal of Finance 7, no. 1 (March): 77–91.

Pfau, Wade D., and Michael Kitces. 2013. Reducing Retirement Risk with a Rising Equity Glide-Path (September 12). https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2324930.

Sharpe, William F. 1964. Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk. Journal of Finance 19, no. 3 (September): 425–442.

Sortino, Frank A. 2009. The Sortino Framework for Constructing Portfolios: Focusing on Desired Target Return to Optimize Upside Potential Relative to Downside Risk. Elsevier.